Cryptocurrency has a long way relationship with volatility. But most of us are unaware of the term “Stablecoins”, which is a specially designed crypto that offers you a steady price.

The word “stablecoin” refers to a cryptocurrency whose value is fixed to the value of another asset. For example, a stablecoin tied to the one dollar should always be worth $1, whatever the market’s volatility.

We know that not all stablecoins are made equal due to recent events. The collapse of TerraUSD in May demonstrated that not all stablecoins could ensure price stability. Here, in this blog we will study about the meaning and most stable Cryptocurrencies for Investment In 2023.

What is Stablecoin?

Stablecoins are specially designed cryptocurrencies made to maintain the stable price of the cryptocurrency over a specific time, and they are pegged to the value of an underlying asset such as US Doller. The objective behind this crypto is to benefit the investor by avoiding rampant volatility.

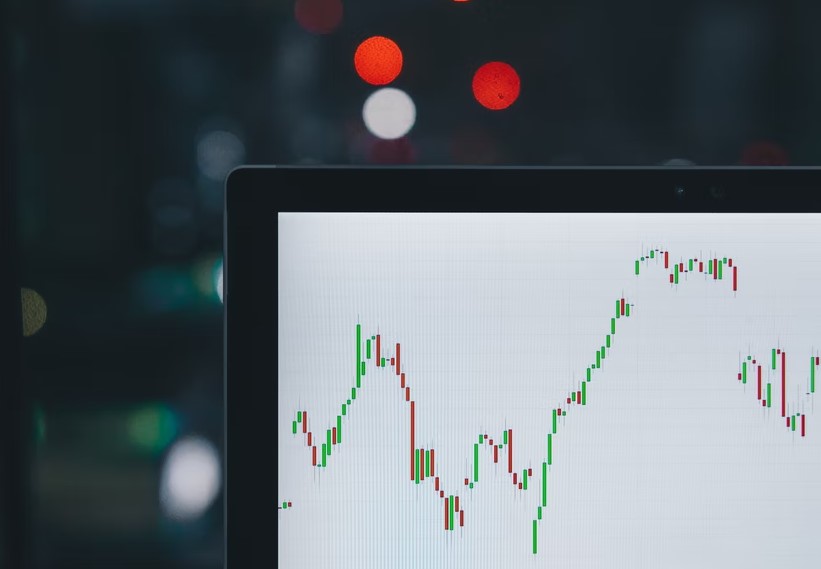

The total market value of cryptocurrencies can fluctuate by millions per day. Even the most popular cryptocurrency, Bitcoin (BTC), is prone to severe price fluctuations. Investors have observed a daily shift in the value of BTC of about 4% over the previous month.

This price instability is not present in fiat currencies like the US dollar or the British pound. Stablecoins can also be thought of as a tokenized form of fiat money.